modefinance Rating Methodology for Banks

modefinance Rating Methodology for banks represents the basis for the credit assessment analysis carried out by modefinance rating analysts.

The analysis is grouped in the following sub-steps:

- BANK AND THE GROUP: considers entity's financial strength (asset portfolio analysis, share performance, diversification...), longevity, legal status, governance and group analysis. The main inputs of this phase are the official and public information by the textual part of the annual accounts (explanatory notes).

- COUNTRY AND SPECIALIZATION: covers the aspects of bank’s position in the country (with respect to its specialization) and relevant news, influence of macroeconomic conditions, political risk and country-specific relevant news.

- FINAL ADJUSTMENT: represents the effect of a final overall assessment of the entity performed by analysts. In this section, the analyst is required to perform a fine tuning of the final assessment taking into account all the information regarding the bank.

Rating for Banks Methodology includes a checklist (“RATING Relevant Information”) which is used by modefinance rating analysts (along with MORE Confidence Level) in order to evaluate the quality and availability of data on the entity to be rated.

Link to the extended PDF document of Rating For Bank Methodology Version 1.0

modefinance MORE For Banks Score Methodology

The Credit Score MORE For Banks by modefinance

The Multi Objective Rating Evaluation (MORE) For Banks model has been developed by modefinance in order to evaluate the level of creditworthiness of a financial institution by using data included in the financial statements. It rates financial institutions based on how well they can meet their financial commitments.

The MORE evaluation has been developed by modefinance and it represents a snapshot of a bank’s financial health.

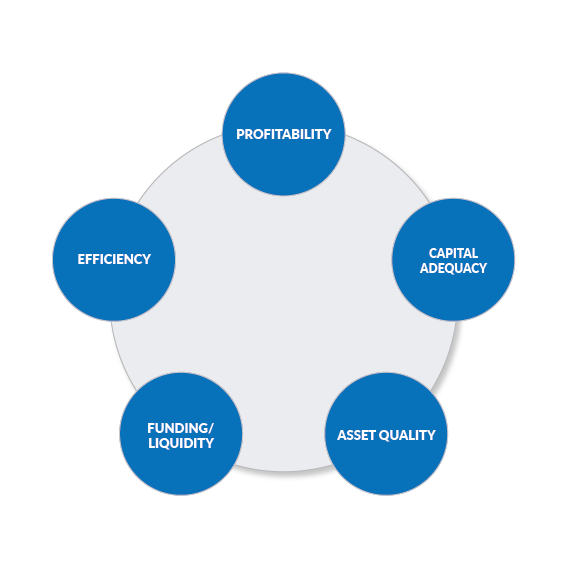

The MORE evaluation is divided into 10 classes and is used by modefinance analysts as a fundamental base for their rating assessment activities; the basic idea of the model is to analyze a set of financial and economic ratios, which are the most predictive under a bankruptcy perspective, with the final purpose of creating a fundamental credit scoring model.

Results of the model are obtained by applying newly developed numerical methodologies, drawing together financial theory, data mining and engineering design methodologies. The hearth of MORE is a multi-dimensional and multi-objective algorithm that produces a classification of each bank, by taking into account specific attributes (country and specialization) characterizing a bank.

Link to the extended PDF document of MORE for Banks Methodology and validation (Version 1.0).